- Develop data science solutions by leveraging Cornerstone, SAS, Python, SQL, Excel, Salesforce tools with Statistical Knowledge in Hive / Machine Learning techniques.

- Own delivery of data science reporting and insights in a highly dynamic, matrix and evolving business landscape.

- Advanced data manipulation & automation skills with Data visualization and Exposure to Big data environment & tools.

- Design and build data science analytical insights/products to help the leadership team evaluate and drive business performance.

- Create and deliver on a roadmap to globalize and digitize the performance reporting.

- Involved in business requirement gathering and designing the Blueprint document as per the Best Practices, workflows and roles and responsibilities.

- Holding regular meetings with the analysts/partners to identify and resolve business and technical issues arising from the projects and BAUs.

- Engage with key stakeholders to drive initiatives to enhance sales experience, Automate and standardize reporting processes.

- Lead, coach, and mentor a team of business analysts to drive data analysis, insights and reporting & enable product enhancements and expansions.

- Ensure Service Level Agreement (SLA) adherence, drive Quality control and continuous improvements.

- Partner with functional leaders, Strategic Business Partners to assess and provide reporting and analytical solutions to fulfil business requirements.

- Demonstrated ability to provide insight and accurate judgment in addressing and resolving business challenges and opportunities.

- Maintaining the Development Control List, Creation of Development functional specifications for the necessary developments as per the requirement.

- Devise process improvement tools and methodologies that will ensure successful and timely implementation of new products or initiatives and drive automation.

- Continuously measure the impact of business insights provided - $ value generated, key business improvements.

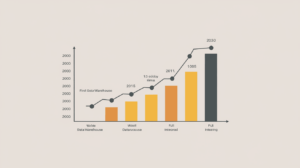

The Evolution of Data Warehousing in the Banking Sector

Introduction Data warehousing has played a pivotal role in the evolution of banking technology. As banks handle enormous volumes of