The Impact of Hyper-Personalization in Digital Banking

Introduction: The Rise of Hyper-Personalization in Digital Banking

In the era of digital transformation, traditional banking is undergoing a paradigm shift. Customers no longer accept generic banking experiences; they demand tailored financial solutions that align with their unique preferences and behaviors. This shift has given rise to hyper-personalization, an advanced approach driven by artificial intelligence (AI) and data analytics. By leveraging real-time data, machine learning, and predictive analytics, banks and financial institutions are now offering personalized products, services, and experiences that enhance customer satisfaction and loyalty.

Why Hyper-Personalization Matters in Fintech

Hyper-personalization in banking is not merely a competitive advantage—it is a necessity. According to a McKinsey & Company report, banks that leverage data-driven personalization can see a 5-15% revenue uplift. Additionally, personalized banking solutions enhance customer retention, reduce churn rates, and drive cross-selling opportunities. With 84% of banking customers expressing interest in personalized financial advice, the shift towards hyper-personalization is reshaping the industry.

Understanding Hyper-Personalization: What Sets It Apart?

Hyper-personalization in banking goes beyond traditional customer segmentation. Unlike conventional personalization, which classifies customers into broad categories, hyper-personalization utilizes real-time data, AI-driven insights, and behavioral analytics to deliver individualized experiences.

Key Technologies Enabling Hyper-Personalization

- Artificial Intelligence (AI) & Machine Learning (ML) – AI algorithms analyze transactional data, spending patterns, and online behaviors to predict customer needs and recommend suitable financial products.

- Big Data Analytics – Banks harness vast amounts of structured and unstructured data to refine customer profiles and create tailored offerings.

- Predictive Analytics – AI-powered models forecast customer behaviors, enabling proactive engagement strategies.

- Natural Language Processing (NLP) – AI-driven chatbots and virtual assistants deliver contextualized interactions based on customer queries.

- Cloud Computing & APIs – Cloud infrastructure and open banking APIs facilitate seamless data integration and personalized banking experiences.

Real-World Applications of Hyper-Personalization in Banking

1. AI-Powered Personal Finance Management (PFM)

Banks are integrating AI-driven personal finance management (PFM) tools that provide real-time insights into a customer’s financial health. These tools categorize expenses, recommend savings plans, and automate budgeting.

Example:

- JPMorgan Chase utilizes AI-powered PFM tools to analyze spending habits and suggest customized savings strategies for customers.

2. Smart Loan & Credit Offerings

Traditional credit assessments often rely on static parameters such as income and credit scores. Hyper-personalization allows banks to assess creditworthiness dynamically, offering tailored interest rates and repayment plans.

Example:

- Goldman Sachs’ Marcus platform uses predictive analytics to offer personalized loan rates based on real-time customer financial behavior.

3. Personalized Investment & Wealth Management

AI-driven robo-advisors offer customized investment strategies based on an individual’s risk appetite, financial goals, and spending behavior.

Example:

- Wealthfront and Betterment leverage AI-powered robo-advisors to provide hyper-personalized portfolio management for clients.

4. Tailored Banking Product Recommendations

Hyper-personalization enables banks to offer products and services that align with customer needs, such as customized insurance plans, investment opportunities, and credit card offers.

Example:

- Wells Fargo uses AI-powered customer analytics to suggest personalized banking products, increasing cross-selling opportunities.

5. Intelligent Customer Support via AI Chatbots

Chatbots equipped with NLP and sentiment analysis provide real-time, context-aware assistance, reducing friction in customer interactions.

Example:

- HSBC’s AI-driven chatbot, Amy, offers personalized responses based on customer transaction history and preferences.

Challenges in Implementing Hyper-Personalization

Despite its benefits, hyper-personalization comes with challenges that banks must address:

1. Data Privacy & Security Concerns

- With the rise of personalized banking, safeguarding customer data is paramount. Compliance with GDPR, CCPA, and PSD2 regulations is crucial.

- Solution: Implement robust encryption, data anonymization, and ethical AI practices.

2. Data Silos & Integration Issues

- Many banks struggle with fragmented data across multiple legacy systems, impeding seamless personalization.

- Solution: Leverage cloud-based data lakes and API integrations to unify customer data.

3. Customer Trust & Transparency

- Excessive personalization can feel intrusive if not executed transparently.

- Solution: Ensure transparency in data usage and offer opt-in/out features for personalized banking services.

4. AI Bias & Ethical Implications

- AI models may introduce biases, leading to unfair credit assessments and financial exclusions.

- Solution: Implement ethical AI frameworks and regular model audits.

Future Trends Shaping Hyper-Personalization in Digital Banking

As financial institutions continue to evolve, the following trends will shape the future of hyper-personalization in banking:

1. AI-Driven Predictive Banking

- Predictive banking will anticipate customer needs and automate financial decision-making.

- Example: AI-powered systems that proactively warn users about potential overdrafts or investment opportunities.

2. Voice-Activated Banking

- Voice-enabled AI assistants will revolutionize digital banking interactions.

- Example: Bank of America’s Erica, an AI-powered voice assistant, provides personalized banking insights.

3. Decentralized Finance (DeFi) & Blockchain-Based Personalization

- Blockchain technology will enhance security while enabling decentralized hyper-personalized finance.

4. Embedded Finance & API-Based Personalization

- Banks will leverage open banking APIs to provide embedded financial services in non-banking platforms.

Expert Recommendations for Banks & Fintech Firms

1. Prioritize Data Governance & Security

- Implement AI-driven fraud detection systems and ensure compliance with global data protection laws.

2. Invest in AI & ML Talent

- Upskilling employees in AI and data science will accelerate hyper-personalization initiatives.

3. Enhance Omnichannel Customer Engagement

- Seamless personalization across mobile apps, websites, and physical branches enhances customer experience.

4. Adopt a Customer-First Personalization Strategy

- Ensure that AI-driven recommendations align with customer needs rather than aggressive sales tactics.

Conclusion: The Road Ahead for Hyper-Personalized Digital Banking

Hyper-personalization in digital banking represents a transformative leap in financial services, enhancing customer engagement, financial inclusivity, and revenue generation. As AI, machine learning, and data analytics continue to evolve, banks and FinTech companies must adopt responsible and transparent personalization strategies to build trust and maximize value. The future of banking lies in AI-powered, customer-centric financial services—where every interaction feels uniquely crafted for the individual.

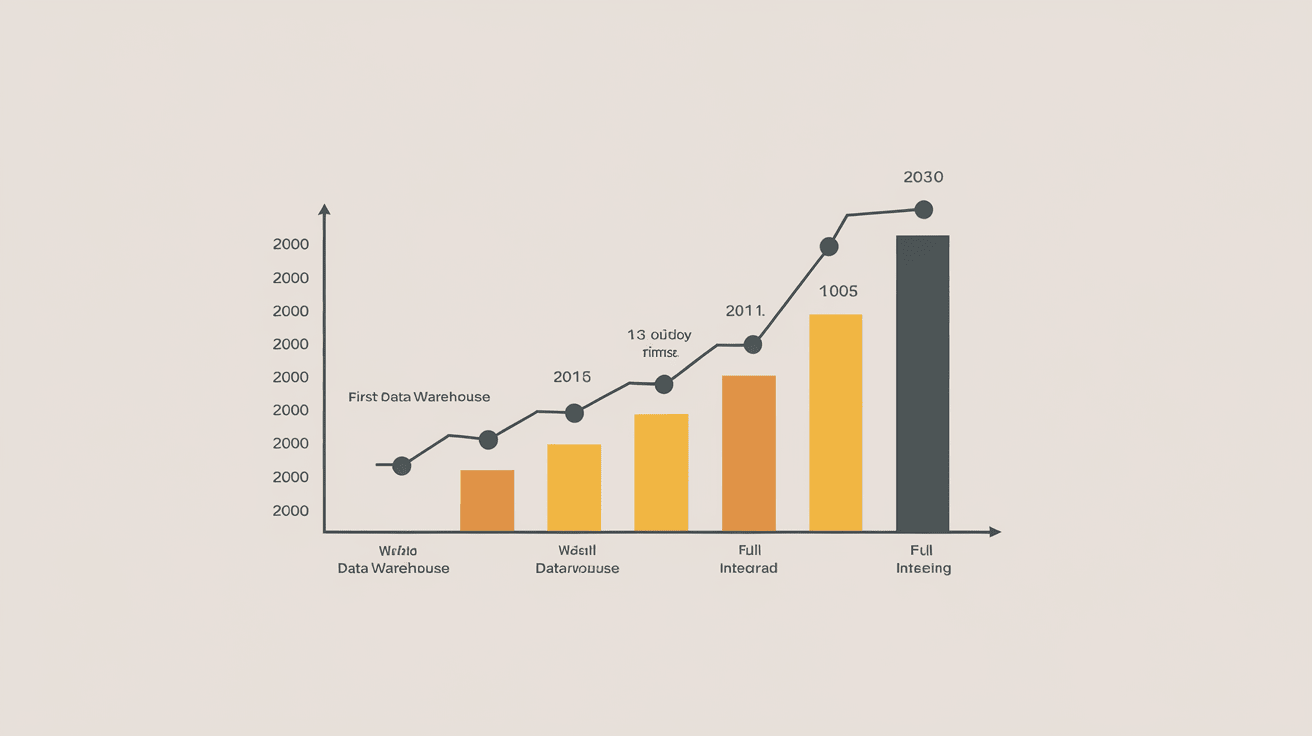

Introduction Data warehousing has played a pivotal role in the evolution of banking technology. As banks handle enormous volumes of…

Introduction The rapid growth of digital banking, financial technology (FinTech), and data-driven decision-making has created a pressing need for scalable…