How Graph Databases Enhance Fraud Detection in Banks

Introduction: The Growing Need for Advanced Fraud Detection in Banking

The banking industry faces an ongoing battle against financial fraud, with cybercriminals leveraging sophisticated techniques to bypass traditional detection systems. Conventional databases struggle to keep up with evolving fraud tactics due to their rigid structure and inability to process complex interconnections in real time.

Enter graph databases—a revolutionary technology transforming the landscape of fraud detection in banking. Unlike relational databases that store data in fixed tables, graph databases store data as interconnected nodes, making them ideal for detecting hidden relationships and suspicious activity patterns.

This article explores how graph databases enhance fraud detection in banks, their real-world applications, the benefits they offer, and case studies from top financial institutions leveraging this technology.

Understanding Graph Databases and Their Relevance in Banking

What Are Graph Databases?

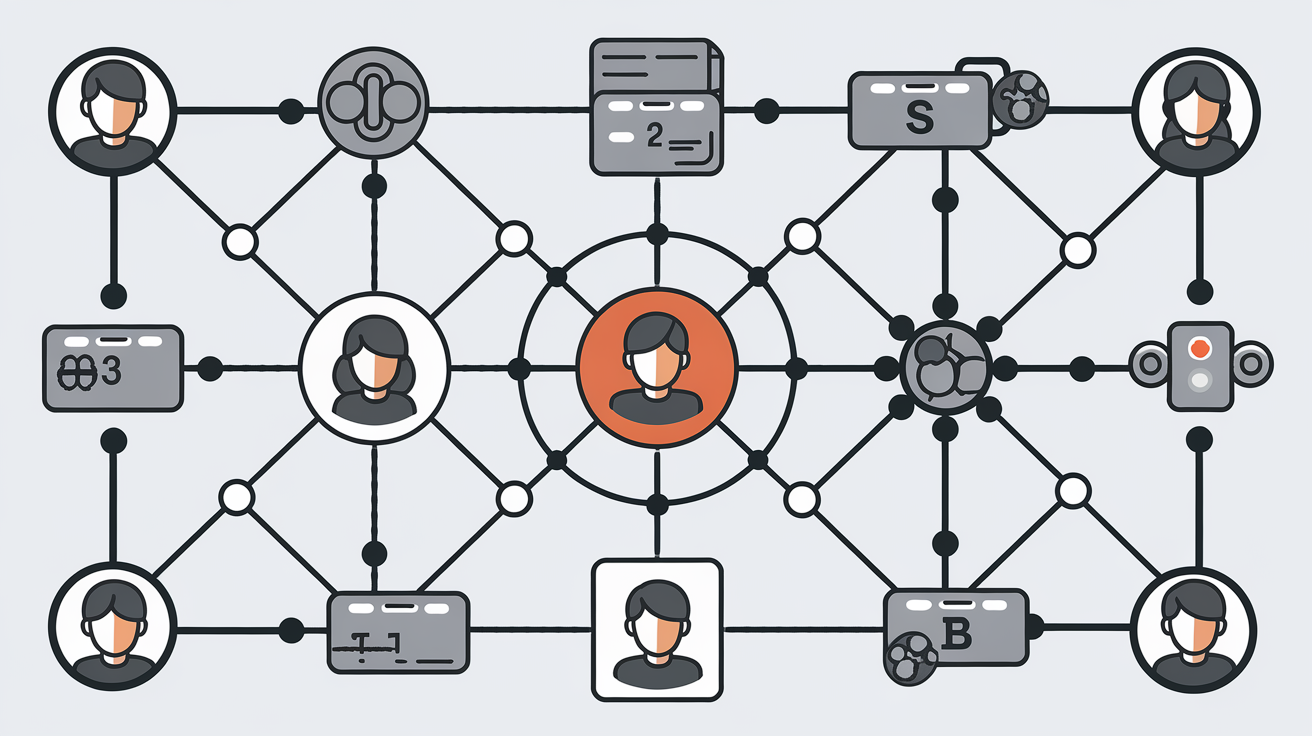

A graph database is a type of NoSQL database designed to store and manage highly connected data. It represents data as nodes (entities such as customers, accounts, and transactions) and edges (relationships between those entities, such as transfers, logins, and authorizations).

Unlike relational databases that rely on SQL queries and table joins, graph databases use graph traversal algorithms, allowing for fast and efficient detection of fraud patterns.

Why Traditional Fraud Detection Fails

Banks have traditionally relied on rule-based systems and machine learning models that analyze structured transactional data. However, fraudsters constantly manipulate identities and relationships, making it difficult to detect fraudulent behavior using conventional methods.

Challenges with traditional fraud detection:

- High false positives – Many legitimate transactions are incorrectly flagged.

- Limited relationship analysis – Traditional databases struggle to track interconnections across multiple accounts.

- Slow processing time – Querying large amounts of data is computationally expensive.

- Static fraud rules – Hardcoded rules cannot adapt to evolving fraud techniques.

Graph databases overcome these limitations by mapping complex relationships in real time, enabling faster fraud detection and mitigation.

How Graph Databases Enhance Fraud Detection in Banks

1. Identifying Suspicious Transaction Networks

Graph databases enable banks to map relationships between multiple entities (customers, accounts, devices) and detect fraudulent patterns before transactions are finalized.

Example:

If a single IP address is linked to multiple credit card applications with different identities, graph traversal can quickly identify suspicious behavior and trigger an alert.

2. Detecting Account Takeover Fraud

Account Takeover Fraud (ATO) occurs when cybercriminals gain unauthorized access to an account. Traditional fraud detection methods analyze individual transactions, but graph databases look at historical connections and behavioral anomalies.

Example:

A fraudster logs into an account from a new device and initiates high-value transfers to multiple newly added beneficiaries. Graph databases can instantly analyze this behavior and compare it with past transaction networks, flagging suspicious activity.

3. Real-Time Money Laundering Detection

Graph databases help uncover money laundering schemes by identifying circular transactions, shell accounts, and layered fund movements.

Example:

A fraudster may route money through multiple bank accounts before transferring it overseas. Graph analytics detect these layered transactions and intermediary account connections, signaling potential money laundering.

4. Uncovering Synthetic Identity Fraud

Fraudsters create synthetic identities by combining real and fake information to open fraudulent bank accounts. Traditional databases cannot link shared attributes, but graph databases can track overlapping relationships.

Example:

- Different accounts share the same phone number, IP address, or social security number.

- Multiple credit applications originate from the same device.

Graph databases connect these data points, exposing fraudulent identities in real time.

5. Preventing Insider Fraud

Graph databases help banks detect internal fraud by mapping relationships between employees, customer accounts, and transactions.

Example:

An employee approves multiple high-value loans for customers with no credit history. Graph databases identify these patterns and raise alerts, preventing financial losses.

Case Studies: How Leading Banks Use Graph Databases for Fraud Detection

1. JPMorgan Chase: Graph Analytics for Money Laundering Prevention

JPMorgan Chase uses graph databases to analyze transactional patterns and detect layered fund transfers linked to money laundering activities. The system identifies suspicious relationships that traditional rule-based models often miss.

2. PayPal: Graph-Based Fraud Prevention

PayPal leverages graph databases to detect fraudulent peer-to-peer (P2P) transactions by analyzing network relationships between users. This allows for instant fraud detection during transactions, reducing fraud losses.

3. HSBC: Detecting Cross-Border Fraud

HSBC integrates graph databases with machine learning models to detect cross-border fraud by analyzing transaction linkages, beneficiary accounts, and device data. This system has significantly reduced financial crime risks.

Benefits of Graph Databases in Banking Fraud Detection

✔️ Faster Fraud Detection: Identifies suspicious activities in milliseconds, preventing financial losses.

✔️ Improved Accuracy: Reduces false positives while increasing fraud detection precision.

✔️ Real-Time Monitoring: Enables continuous tracking of transactions and relationships.

✔️ Scalability: Handles billions of transactions efficiently.

✔️ Enhanced Regulatory Compliance: Ensures adherence to AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations.

Emerging Trends in Graph-Based Fraud Detection

🔹 AI-Powered Graph Analytics: Integrating AI with graph databases for predictive fraud detection.

🔹 Graph Neural Networks (GNNs): Advanced machine learning models for deep fraud insights.

🔹 Blockchain & Graph Databases: Strengthening fraud prevention in crypto transactions.

🔹 Integration with Big Data: Enhancing fraud detection by combining graph databases with real-time data lakes.

Challenges and Considerations

🚧 Implementation Complexity: Requires technical expertise for integration.

🚧 Data Privacy Issues: Compliance with GDPR, CCPA, and banking regulations.

🚧 Cost of Deployment: Higher initial investment compared to traditional databases.

🚧 Scalability Management: Optimizing performance for large-scale fraud detection.

Future of Fraud Detection with Graph Databases

As financial fraud evolves, banks must embrace advanced fraud detection systems to stay ahead. Graph databases will play a pivotal role in enhancing fraud detection by providing:

🔹 Hyper-accurate fraud scoring models

🔹 Real-time anomaly detection

🔹 Seamless integration with AI-driven fraud analytics

🔹 Decentralized fraud prevention using blockchain and distributed ledger technology

Conclusion: Why Banks Should Invest in Graph Databases for Fraud Detection

The banking industry must move beyond traditional fraud detection methods to combat sophisticated cyber threats. Graph databases provide a powerful tool for uncovering fraud patterns, improving regulatory compliance, and safeguarding customer assets.

With real-time fraud detection, advanced relationship mapping, and AI-driven insights, graph databases are the future of banking security. Banks that invest in this technology today will gain a competitive edge in preventing fraud and ensuring a secure digital banking ecosystem.

GraphDatabases #BankingSecurity #FraudDetection #FinTech #AML #CyberSecurity #AI #DataScience #MachineLearning #KYC #DigitalBanking #RiskManagement #FinancialCrime #BigData #NeuralNetworks #RegTech #BankFraud #FraudPrevention #FintechTrends #AntiMoneyLaundering

Introduction: The Growing Need for Secure Data Management in Banking Data security and integrity are critical challenges in the modern…

Introduction: The Growing Need for Real-Time Fraud Prevention in Banking The rapid digital transformation in the financial sector has led…